Someone once said that Ponzi schemes in Nigeria or anywhere are a fraudulent investment where you rob Peter to pay Paul. As funny as it sounds, that is undoubtedly the bitter truth. It is an operation where the operator generates returns for older investors through funds paid by new investors. And the cycle goes on and on. These interesting rich quick schemes rocked Nigeria towards the latter months of 2016. Kai! With the tedious hustle of the ‘ember’ month, most people fell as easy prey. Let’s do a countdown of the worst five so far. We’ll start from the least.

Ponzi Schemes In Nigeria That Wreaked Major Havoc

1. iCHARITY

First on our list is iCharity club. It is an international network of donors which works with a peer to peer model of operation.

Once you become a registered member, you would have to donate to your upliner. This way, you become a grade one member in the scheme. Afterward, the system will link you up to 5 members who will, in turn, donate to you. It works as an ascending slope where a grade one member earns ₦37,000. Next is the grade two where you earn ₦370,000 and finally a grade three-member earns ₦3,700,000.

This Ponzi scheme was quite popular in its time. It ranked as one of the most popular Ponzi schemes in Nigeria and was also rated the 71st most visited website in Nigeria but soon flew with the wind.

2. GIVERS FORUM

This is next on our list. It is also another community of givers who donate funds to assist each other financially. It worked on the principle of percentage growth.

Upon registration, you are expected to indicate an intention to ‘provide help’. Afterward, your account will be rewarded with the same amount you relinquished. Your money grows according to the amount of fund you donate at the rate of 10% per week plus other bonus. This also determines the amount of fund you are entitled to at the end of the week. Inability to provide the help requested with 48hours during the week and 98hours on weekends is the password to leaving the system. As one of the celebrated Ponzi schemes in Nigeria, Givers Forum had its fair share of fame but was nowhere to be found by January 2017.

3. ZAR FUND

We won’t fail to mention Zarfund. It was the 3rd most popular Ponzi scheme in Nigeria. It was created by a South African online entrepreneur by name Hannes Jordaan. It operated as a person to person funding and donation sharing platform.

Initially, members paid their referrals voluntarily in form of a donation to participate in the scheme. It was a complete 6 level monthly referral operation. Then, they moved on to transactions using digital cryptocurrencies like ‘Bitcoin’. It changed to a 2 × 6 structure model which only works with Bitcoins. Donations were made via bitcoins and bitcoin wallets were used to receive payments.

Unfortunately, like the other Ponzi schemes in Nigeria, Zar Fund did not stand the test of time. It found its way out of the game in December of 2016.

4. ULTIMATE CYCLER

Next in line is the Ultimate Cycler. This Ponzi scheme was in cooperated by Peter Wolfing, a United States-based network marketer.

It worked with the same peer-to-peer model. Members were required to pay ₦12,500 after which they would have 4 new members placed under them who would each pay ₦12,500 into the member’s bank account. Members who could not wait for the system to do this were allowed to bring people who would register under them and provide the supposedly ₦37,500 return on investment. There was no central account for transactions. All payments were received directly into the individual’s account. Due to its 6 matrix level plan, members were encouraged to lure other people in to ensure the continuity of the scheme.

However, this scheme packed up on 1st December 2016 due to a technical downtime which was never successfully fixed.

Check Out: 9 surprising ways Millennials Are Making Money Online

5. MMM

Ah! The king of them all. MMM is a Russian company which was involved in one of the world’s largest Ponzi schemes of all time during the 1990s. It was established by three friends Olga Melnikova, Sergei Mavrodi and his brother Vyacheslav Mavrodi in 1989. Thus the company name was drafted from the first letters of their surnames ‘MMM’. It was rebranded as MMM Global in 2011 and subsequently came into Nigeria as ‘Mavrodi Mundial Moneybox’ in November 2015.

MMM came along with an incredible mouth-watering offer. They rewarded 30% return on any amount invested for a period of 30 days. Members were allowed to have several persons registered under their names. This attracted a bonus for each revenue paid by these individuals. It soon included digital cryptocurrency transactions in its operations. MMM took over the cyberspace with an aggressive online campaign. It ranked the 5th most visited website in Nigeria. It was also believed to have amassed over 3 million participants. And with the scorching recession at bay; more people kept embracing this scheme despite several warning of its instability.

The Securities and Exchange Commission (SEC) issued a warning against the operations of this scheme on August 30, 2016. They stated that MMM has no tangible business model and has thus not registered its operations with the Commission. They further instructed that any individual involved in such operations did so at his own risk. The Central Bank of Nigeria also warned citizens not to make any kind of investments with institutions unrecognized by the Nigeria Deposit Insurance Cooperation (NDIC). The House of Representatives even ordered a probe into the organization’s activities. Reports of previous MMM scandals filled the air but our people no gree hear because man must chop. Each warning was met by a fierce and vile resistance. Trust Naija people with our bad mouth.

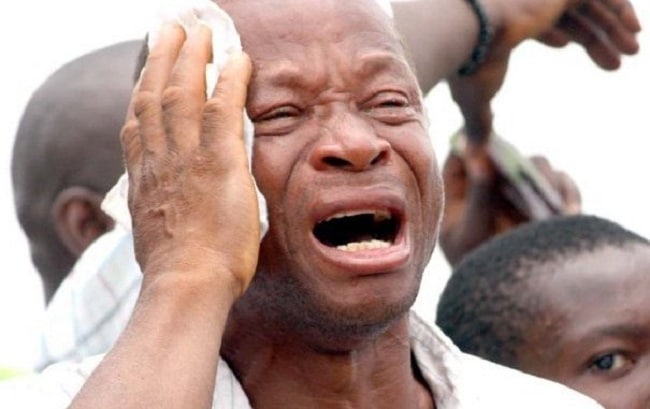

Alas! On a beautiful Tuesday morning in December 2016, the great MMM came crashing down the hill. Our nation was thrown into pandemonium as most people’s funds went with the wind. It was reported by the Nigerian Deposit Insurance Commission (NDIC) in March 2017 that approximately ₦18 billion was lost to Ponzi schemes in 2016 of which more than half is accredited to MMM. As such, it is not surprising that MMM is for many people, the leader of all the terrible Ponzi schemes in Nigeria.

Here ends our list!

The Ponzi scheme saga goes to show that most Nigerians are high-risk takers and sadly, still seek the short route to success. We don’t want to soil our hands to make daily bread. We always want easy money, free lunch, free rides, free tips etc. We too like free things.

However, we must know that greed never really pays. You may enjoy the ride for a while but; its only a matter of time before the ‘sowing and reaping’ principle of life kicks in. Let us learn to be patience and follow the trusted route to long-lasting success. I don talk my own ohhhhh! Remember, wisdom is profitable to direct. There will be more Ponzi schemes in Nigeria, it’s up to you to decide if you’ll be heartbroken again or not.